U.S. Supporters: The CARES Act

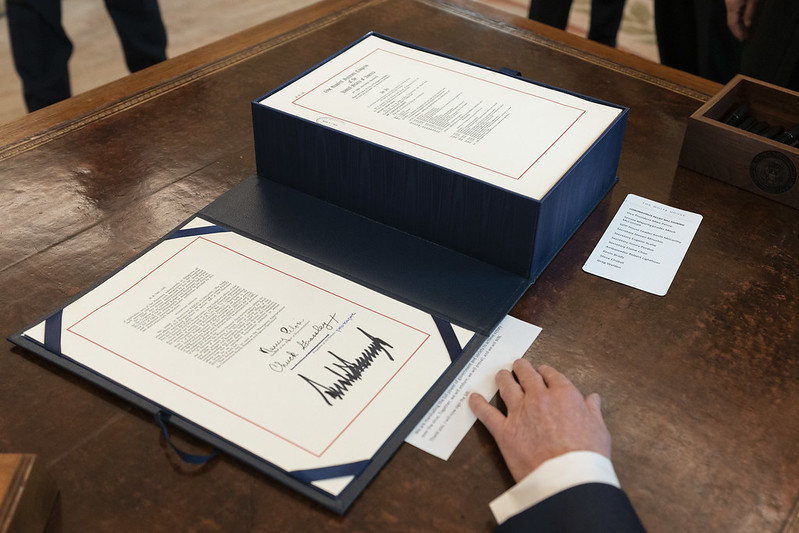

The CARES Act was signed on March 27, 2020

The CARES Act was signed on March 27, 2020

Tax incentives brought about by the CARES Act for 2020 are extended to the 2021 tax year. One provision of the CARES Act is that it creates charitable giving incentives for donors to nonprofit organizations like Nonviolent Peaceforce.

If you do not itemize on your taxes:

You can include $300 in charitable contributions as a one-time, above-the-line deduction for your 2021 taxes. This means you don’t have to itemize other items to claim this deduction. The new bill also expanded that universal charitable deduction to include those filing jointly. Those filing jointly will now be able to deduct up to $600.

If you do itemize on your taxes:

The cap for giving has been increased from 60% to 100% of adjusted gross income for your 2021 taxes. By making a donation to Nonviolent Peaceforce, you can get more impact on your taxes from donations this year.

During a pandemic, violence continues, but there are fewer witnesses. Thank you for supporting Nonviolent Peaceforce to bear witness and continue protecting people who need it the most. We hope you will consider a gift today to spread peace.

P.S. If you do not need your stimulus check, consider donating it with a portion going to meet needs in your local community and a portion to support your international community at Nonviolent Peaceforce.

Protection of Civilians Camp in South Sudan

Protection of Civilians Camp in South Sudan